The Democratic Republic of Congo (DRC), the world’s largest cobalt producer, is enforcing strict measures to ensure exporters adhere fully to cobalt export quotas. Starting October 16, 2025, the state minerals regulator ARECOMS will revoke export rights from companies that do not export their full allocated cobalt volumes, violate tax or environmental rules, or transfer quotas unlawfully. This policy aims to stabilize the cobalt market, prevent fraud, and secure economic benefits for the nation.

Background and Policy Overview

Cobalt, vital for electric vehicle batteries and tech industries, is predominantly sourced from Congo, which controls about 70% of global supply. Due to a price crash earlier in 2025, Congo imposed a complete cobalt export ban in February that successfully boosted prices by over 90%. Now, Congo has eased the ban, replacing it with a government-controlled export quota system managed by ARECOMS to balance supply and maintain price stability.

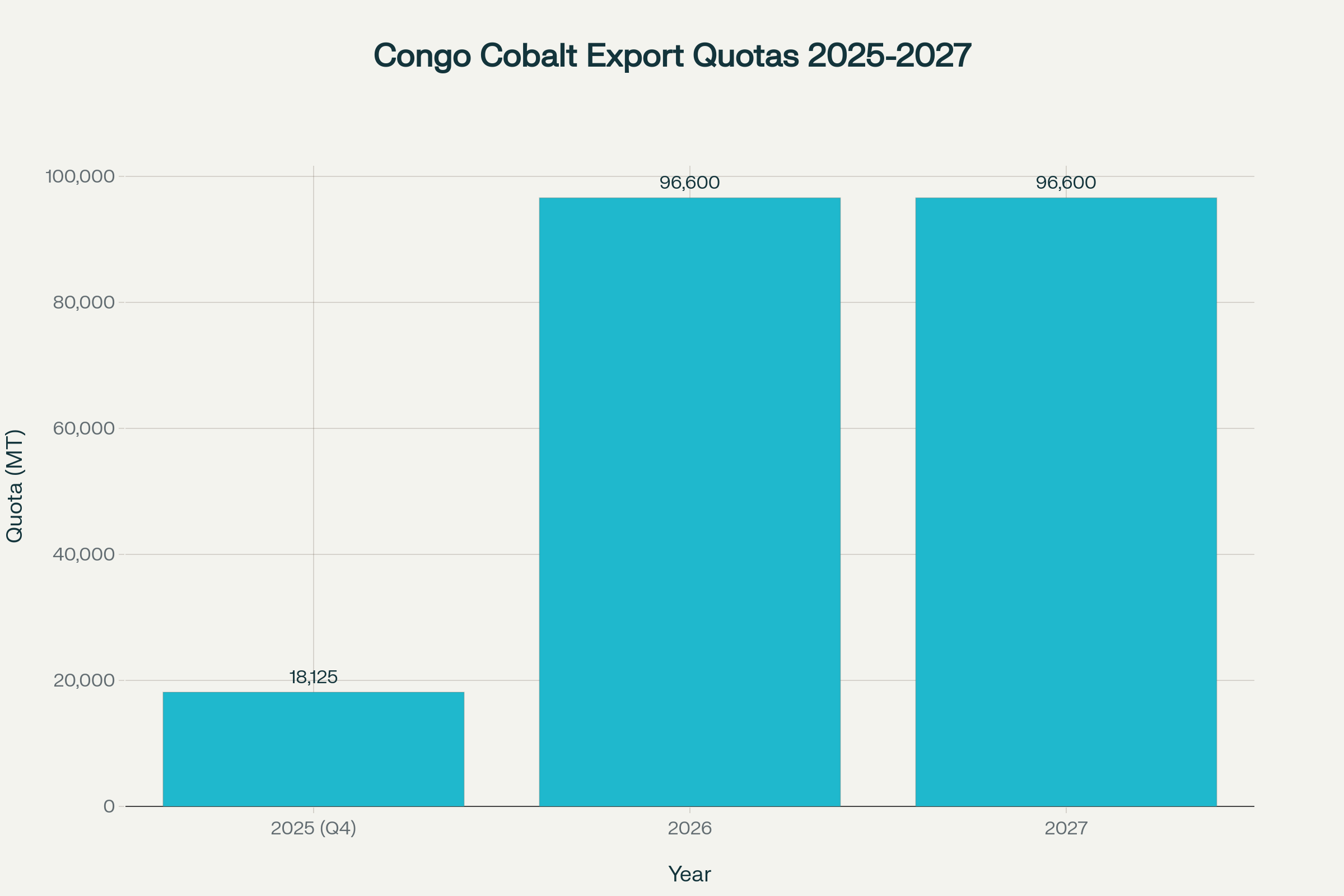

The quota system grants specific annual export limits for miners based on historical export data: 18,125 metric tonnes for Q4 2025 and 96,600 metric tonnes annually for 2026 and 2027. ARECOMS holds full authority to allocate, monitor, and revoke quotas.

Enforcement and Sanctions

President Felix Tshisekedi has warned of “exemplary sanctions” against exporters failing to honor their full export volumes, including permanent bans. This zero-tolerance approach targets quota breaches, avoidance tactics, and illegal transfers aimed at manipulating the system. Companies must develop compliance systems to align with these regulations, or face exclusion from Congo’s cobalt export regime.

Impact on Major Producers and Global Market

Key players like China’s CMOC and Swiss miner Glencore received quotas for late 2025 and must comply strictly or risk losing critical export permissions. The policy is part of Congo’s resource nationalism drive to maximize the cobalt sector’s benefit domestically while influencing global supply chains and mineral prices.

This tighter control could affect supply chains and battery production costs internationally, possibly accelerating interest in cobalt alternatives. However, Congo’s primary aim is sustainable development through regulation ensuring cobalt trade transparency and legal compliance.

Congo Cobalt Export Quotas 2025-2027

| Year | Export Quota (Metric Tonnes) | Notes |

|---|---|---|

| 2025 (Q4) | 18,125 | Quota set for last quarter; transition from full export ban |

| 2026 | 96,600 | Annual quota for full year; capped |

| 2027 | 96,600 | Annual quota for full year; capped |

Table depicting Congo’s regulated cobalt export quotas for Q4 2025 through 2027 with annual limits controlled by ARECOMS.

Conclusion

Congo’s new directive to revoke cobalt export quotas for non-compliant companies reinforces its dominant role in cobalt production governance. By enforcing full volume exports and prohibiting unauthorized quota transfers, Congo aims to stabilize the cobalt market, increase economic returns, and ensure sustainable cobalt supply. The policy highlights growing resource nationalism and signals changes that could ripple through global electric vehicle and tech industries reliant on cobalt.

This decisive action places Congo at the center of cobalt’s future, balancing its export potential with regulatory control for national and global benefit.